When you’re chewing on life’s gristle, don’t grumble, give a whistle and … always look on the bright side of life.

— Lyrics from “Always Look on the Bright Side of Life” from the film “Life of Brian”

Taking a look back at May market activity, the S&P 500 extended its 2023 gains, rising another 0.50% to bring the year-to-date total return to 9.65%.1 This brings price gains in the S&P 500 to 17% since the October bottom.2 Surprising many, the leadership has been in the more risk-on sectors of the market including information technology, communication services and consumer discretionary that have advanced 34%, 33% and 19%, respectively.3 Growth stocks have well outperformed value stocks this year, which syncs up nicely with our consistent message to maintain balance in equity portfolios and not abandon healthy exposure to growth-oriented businesses.

Many experts had suggested going into this year that it was value stocks’ time to shine, and that “long duration” growth stocks were dead. We’re pleased we didn’t buy into the head fake. I guess these folks might have missed the news on artificial intelligence (AI) and what some of these great AI companies can do to drive productivity and maintain cybersecurity, which are essential to the global economy.

Inflation Has Calmed, Positive Earnings News

There were other fundamentally good things that happened in May. Inflation continued to calm. The Federal Reserve hiked interest rates by another 25 basis points but signaled a potential pause in rate increases. Earnings news for the first quarter came in far better than feared with earnings falling by a mere 3% year over year through the first quarter versus the 7% decline that was expected. 77% of companies bested expectations, which is well above 2022’s fourth quarter figure of 68%.4 In fact, forward earnings revisions have stabilized and are trending back up. Third and fourth quarter 2023 earnings growth is expected to be positive given the easing in prior-year comparisons in these upcoming quarters, and 2024 calendar year earnings expectations of double-digit growth are holding fast.5 Other good news? Consumer spending rose sharply in April, rising 0.8% month over month versus the 0.1% month-over-month pace in the prior two months.6 Services spending is particularly strong as folks are happy to take cruises, fly, dine out and enjoy various experiences together.

U.S. Debt Ceiling Debate Nothing New

As for a lingering wall of worry item we have been writing about for some time, the U.S. debt ceiling debate, it does look like both sides in Washington have come together with a compromise bill to raise it and to do so through the end of 2024. No surprise to us regarding the outcome or the style in which it was accomplished. This political theater is something we’ve endured over the 20 times that the debt ceiling has been raised since 2002—virtually always in similar fashion. So much so that it has become a truly silly political tradition. The politicians threaten default and hold each other hostage (as well as investors) until the last moment. They know it is political suicide for both sides unless they ink a deal ahead of the looming default date. The self-serving rhetoric gives us a little more stock market volatility to worry about until the vote is taken, cooler heads prevail, and the debt ceiling is raised for another year or so. Spend too much and ignore the debt ceiling constraints, then argue about debt ceiling consequences that were ignored when the spending was approved, threaten default unless you get concessions from your political foe, yet come together in the final hour. In this year of policy and economic transition, it eases another burden investors have had to navigate on the heels of pandemic-related distortions.

A Little Levity Goes a Long Way

To lighten the mood for a moment and help us cope with Washington’s various fiscal and monetary policy debates in process, some satire seems in order. These various policy pronouncements bring to mind the Monty Python song I referenced above, “Always Look on the Bright Side of Life.” While no doubt the song is rather satirical, its intended message from composer Eric Idle is a sincerely positive one. He was merely trying to acknowledge that on most occasions our negativity biases cloud the real picture and the generally positive stuff that is happening under the surface. We get caught up in all the drama or we don’t study the facts enough to realize we are far closer to victory than we think.

Folks start to fear default on U.S. bonds because of overly dramatic debt ceiling media coverage and forget that it has never happened and that government revenues are five times greater in size than the interest payment obligations on our debt. So, even if a default occurred, it would be technical, not real.7 We have cash! Similarly, Barron’s notes that when Fed Chair Jerome Powell speaks at a press conference following a Fed rate decision, the market is three times more volatile than under previous Fed chairs.8 People panic not at what Fed action was taken but in the way that Powell explains it and the way the media covers it. After all, the real story is that inflation is getting less worse, the Fed is hinting that it is almost done and interest rate policy has gone back to normal—or the long-term average fed funds rate of close to 5%.9 For one second, let’s look at the bright side of life. Specifically, look at the fact that at the end of the fiscal policy day, the debt ceiling was lifted as normally occurs, and on the monetary policy front, we have gone back to normal interest rate levels. Neither outcome sounds so awful to us.

Stuck In Neutral – The Facts and Our Message

The economy is only in recession 13% of the time, and the U.S. stock market is up 80% of the time when looking at data going back to 1980.10 So, if you are negative on the economy and the market, you better have the negative data to back up your pessimistic view or it could cost you significant wealth.

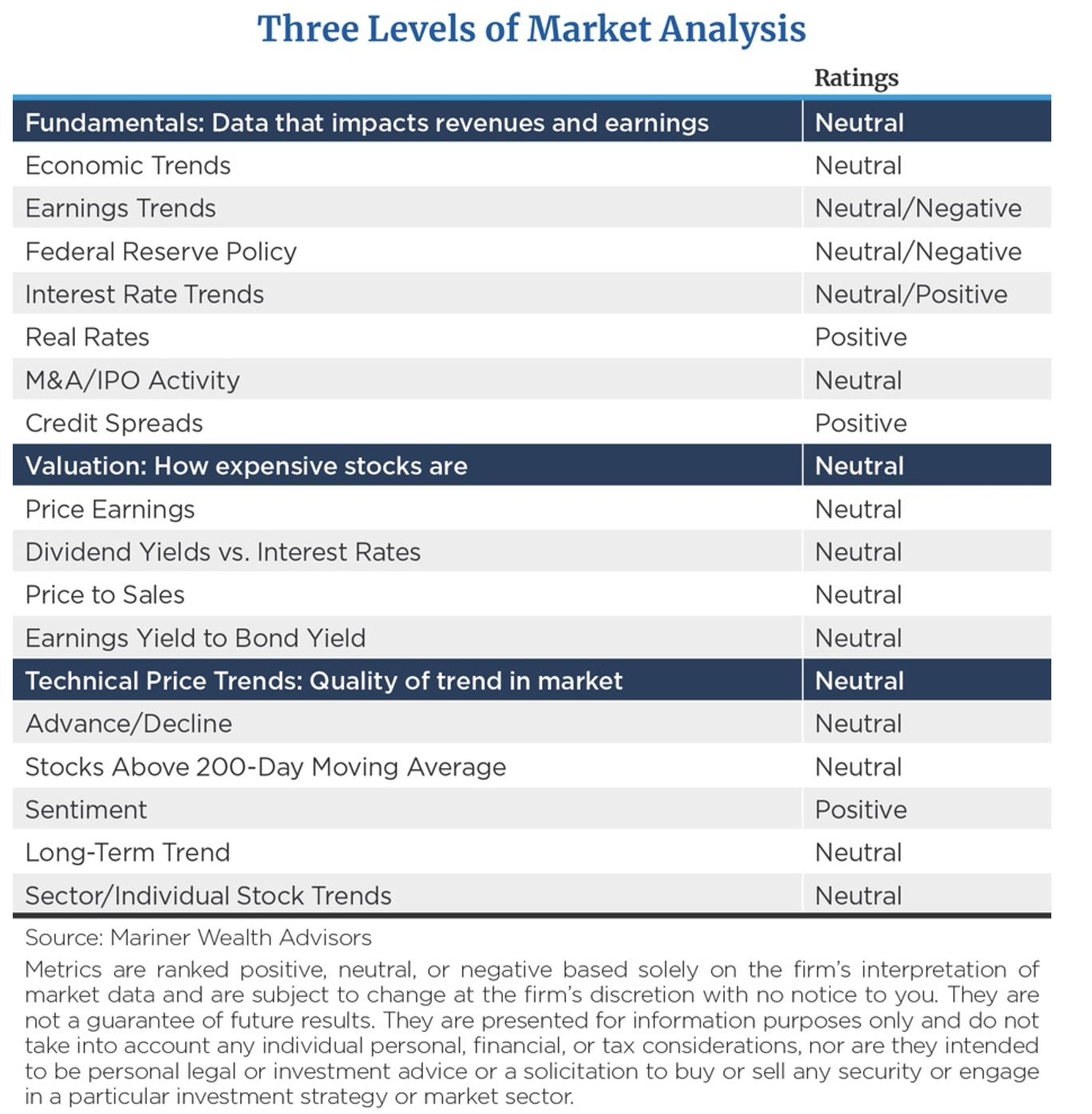

Currently the data is mixed or neutral, not hovering in the negative zone nor at the “all clear”/positive level either. In last month’s commentary, I noted that when assessing the market, we look at three levels of analysis: fundamental, valuation and technical (F’s, V’s, T’s). Each is neutral.

On fundamentals, earnings are better than feared, and employment is quite strong, yet there are pockets of weakness in housing and in the durable goods sectors of the economy.

Valuation levels aren’t cheap, but they aren’t expensive either. S&P 500 price-to-earnings/next 12-month (P&E/NTM) levels at 18 times earnings are just about at the 10-year average of 17.5 times.11 Yet, if you exclude the 10 largest stocks that sport inflated P/E’s of nearly 27 times, the other 490 S&P 500 stocks are trading below the 10-year average.12

Regarding the technical price trends in stocks, it’s true that the market is narrower than we would like with the largest eight stocks contributing significantly to S&P 500 returns, but it is also true that there are a lot of “non-mega eight” stocks that are up 20% to 50% this year as well. Some misuse the metrics and imply that “the largest eight stocks in the S&P 500 account for all the returns of the Index” and thus imply all the other 492 or so are down. That is absolutely false! There are a number of those other 492 that are also performing quite well. When we look at the technicals—the number of stocks advancing versus declining, the percentage above their 50-day and 200-day moving average, etc.—we find them to be neutral as well. It is this combined neutral reading in the F, V, T metrics, as we call them, that drives our “hold your ground” message. Don’t buy aggressively, but don’t sell down your current stock exposure either.

If anything, we are biased to waive the “buy on the dips” flag once we push past this next quarter of inflation data, get another Fed decision on the books and see how the second quarter earnings news flow evolves in the July time frame before getting more positive. Good trends in these areas would catch our attention.

What Recession?

Economists are beginning to apologize a bit for being so bold in their predictions of recession that was supposed to happen in 2022, then in early 2023 and now perhaps in late 2023 or sometime in 2024. They are acknowledging that they have suggested it was “six months away” for the past couple of years and, similar to the Fed’s prophecy that inflation was “transitory,” perhaps their prediction of looming recession was off the mark. At least it has been elusive so far. At some point, they will be right… we will have a business cycle. At present, though, the U.S. economy appears very resilient. The traditional indicators, such as the inverted yield curve, declining leading economic indicators and softening spending on manufactured goods, don’t seem to be as effective on calling a dip this time. Why is that? Ed Yardeni of Yardeni Research and our own Chief Economist William Greiner offer a couple of reasons why, despite the clear recessionary signals emitted by traditional indicators, the U.S. economy is still plugging along:

- We continue to see strong employment levels as employers are loath to lay off folks given the tight labor force and cost to recruit and train in a post-pandemic world.

- Retirees are benefiting from the government payments received during the pandemic and the returns on bond portfolios following consistent Fed rate hikes, and they are big spenders on experiences like dining out.

- Capital spending is holding up given the infrastructure spending bills passed to keep our technology sector competitive, restore our infrastructure and incent re-onshoring of companies’ supply chains.

- The economy is experiencing pockets of weakness this cycle unlike the boom-and-bust periods of years past when every industry group seemed to suffocate at the same time. For example, residential housing is soft but multifamily housing is on fire, so overall construction employment continues to rise.

- Productivity is troughing following an unusually high labor force quit rate. Once workers stay on the job for a while and know where the water cooler is, they’ll become more productive quickly. Dramatic improvements in technology, like AI, will also drive productivity gains.

Greiner recently took his odds of a soft economic landing up to 50%, and while he still believes there is a 50% chance of mild recession, he agrees it would be light should it occur. Our collaborative expectations are for real gross domestic product growth in a range of -0.5 to +1.5 with a midpoint of 1% growth. That is hardly cataclysmic and supports decent earnings growth in 2023 and 2024. These are the assumptions backing our 4,500+ target for the S&P 500 by year-end.

Wrap-up

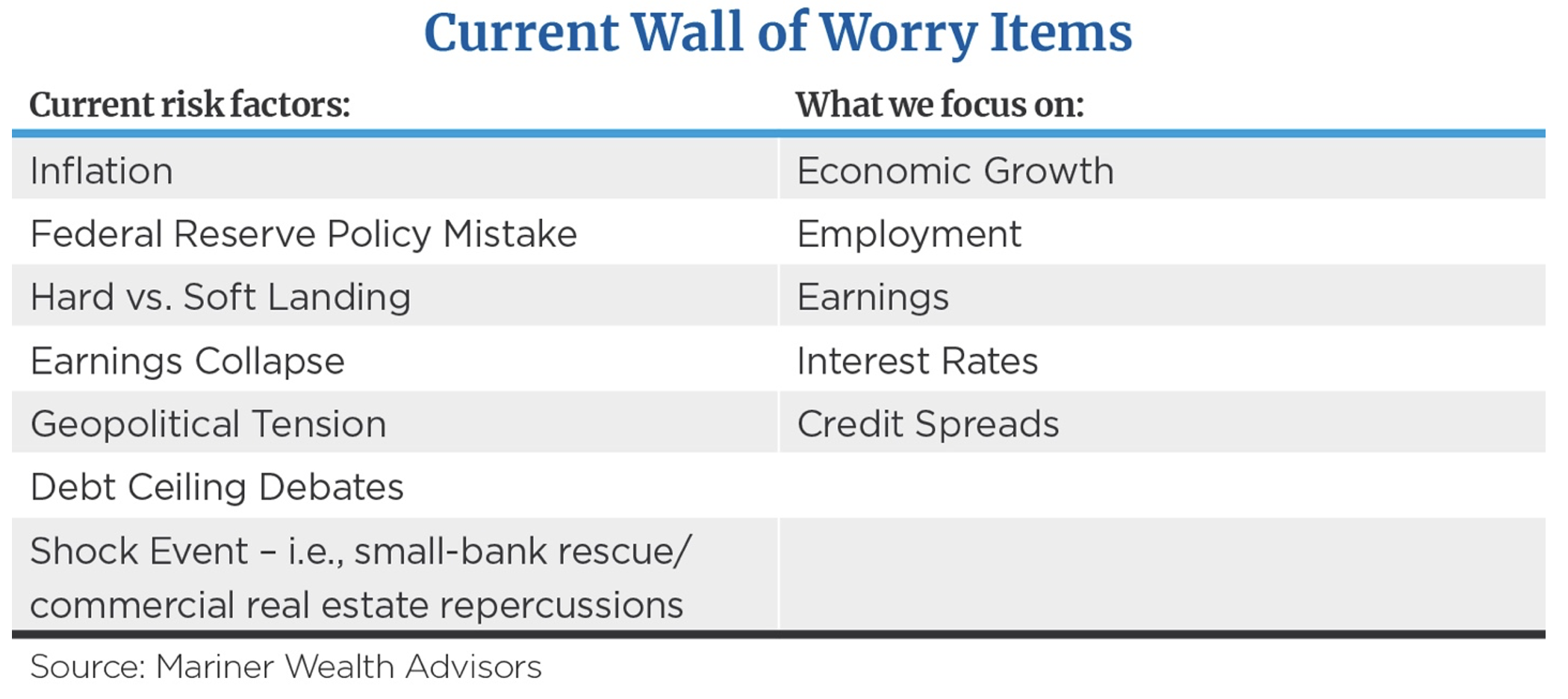

The Wall of Worry Items in the table below is certainly lengthy.

However, as we like to say, the only time we really worry is when there is no wall of worry. When that’s true, everyone has thrown risk out the window and the last investor dollar is in the market already. A long list says investors are appropriately respectful of risk and that more money can be made. That’s what we see today. My colleagues on the internal equity team and I see plenty of opportunity in the individual stock strategies we manage. We believe having exposure to actively managed portfolios is worth considering.

In the book I am currently reading, “Factfulness,” by the late Dr. Hans Rosling, he liked to call himself a “possibilist.” As a medical doctor, professor of international health and researcher, he was committed to understanding and reporting on the evolving world order and condition in the areas of health, poverty, education, etc. In doing so, when he would cite the improving trends in these areas in his writings, he noted that people often referred to him as an optimist. He refuted that label, explaining that made him sound naïve and biased. On the other hand, according to Dr. Rosling a possibilist is “someone who neither hopes without reason, nor fears without reason… someone who constantly resists the overdramatic worldview.” I think I would have liked him a lot!

Footnotes:

1,2,3,4,5 FactSet

6 U.S. Bureau of Economic Analysis, Personal Income and Outlays April 2023

7 Congressional Budget Office, The Budget and Economic Outlook 2022-2023

8 The Market Impact of the Fed Press Conference March 2023

9 St. Louis Federal Reserve, Federal Funds Effective Rate

10 Historical Returns on Stocks, Bonds and Bills: 1928-2022 and National Bureau of Economic Research: U.S. Business Cycle Expansions and Contractions

11,12 FactSet

The S&P 500 Index is a market-value weighted index provided by Standard & Poor’s and is comprised of 500 companies chosen for market size and industry group representation. The index is unmanaged and cannot be directly invested into. Investing involves risk and the potential to lose principal. Past performance does not guarantee future results.

This commentary is limited to the dissemination of general information pertaining to general economic market conditions and is for informational and educational purposes only. The views expressed are for commentary purposes only and do not take into account any individual personal, financial, or tax considerations. As such, the information contained herein is not intended to be personal legal, investment, or tax advice or a solicitation to buy or sell any security or engage in a particular investment strategy. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass. Any opinions and forecasts contained herein are based on the information and sources of information deemed to be reliable, but we do not warrant the accuracy of the information that any opinion or forecast is based upon. You should note that the materials are provided “as is” without any express or implied warranties. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Consult your financial professional before making any investment decision.

Mariner Advisor Network is a brand utilized by Mariner Independent Advisor Network (“MIAN”) and Mariner Platform Solutions (“MPS”). Investment advisory services are offered through Investment Adviser Representatives registered with MIAN or MPS, each an SEC registered investment adviser. Registration as an investment adviser does not imply a certain level of skill or training. MIAN and MPS comply with the current notice filing requirements imposed upon registered investment advisers by those states where they transact business and maintain clients. MIAN and MPS have either filed notice or qualify for an exemption or exclusion from notice filing requirements in those states. Any subsequent, direct communication by MIAN or MPS with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about MIAN or MPS, including fees and services, please contact MIAN/MPS or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you invest or send money.

For information about which firm your advisor is registered with, please refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov) or the Form ADV 2B provided by your advisor.

Investment Adviser Representatives are independent contractors of MPS or MIAN and generally maintain or affiliate with a separate business entity through which they market their services. The separate business entity is not owned, controlled by, or affiliated with MPS or MIAN and is not registered with the SEC. Please refer to the disclosure statement of MPS or MIAN for additional information.

Mariner Wealth Advisor is the parent company of Mariner Advisor Network, MIAN and MPS.